The Forex foreign exchange market is one of the largest and liquid financial markets in the world, with an average daily trading volume exceeding 6 trillion. It operates 24 hours a day, five days a week, offering countless opportunities to profit from global currency trends. However, successfully navigating the Forex market requires a solid understanding of the factors that drive currency movements and a strategic approach to trading. Currency values fluctuate due to various factors, including economic indicators, geopolitical events, central bank policies, and market sentiment. Economic indicators like GDP growth, employment rates, and inflation directly affect a country’s currency value. For example, a strong GDP growth rate generally leads to a stronger currency, as it signals a healthy economy that attracts foreign investment. Conversely, high inflation can erode a currency’s value by decreasing its purchasing power. Geopolitical events, such as elections, wars, or trade disputes, can also significantly impact currency values.

For instance, political instability often leads to currency depreciation as investors seek safer assets. On the other hand, positive developments, like trade agreements, can boost a currency’s value by enhancing economic prospects. Central banks play a crucial role in shaping currency trends through monetary policies. Interest rate decisions, in particular, are a major driver of currency movements. Higher interest rates attract foreign investors seeking better returns on investments, leading to currency appreciation. Conversely, lower interest rates can lead to currency depreciation. Market sentiment, which reflects the overall mood of traders and investors, also influences currency prices. A risk-on sentiment, where investors are willing to take on more risk, usually strengthens higher-yielding currencies. In contrast, a risk-off sentiment, driven by fears of economic downturns or financial crises, tends to strengthen safe-haven currencies like the US dollar, Swiss franc, and Japanese yen.

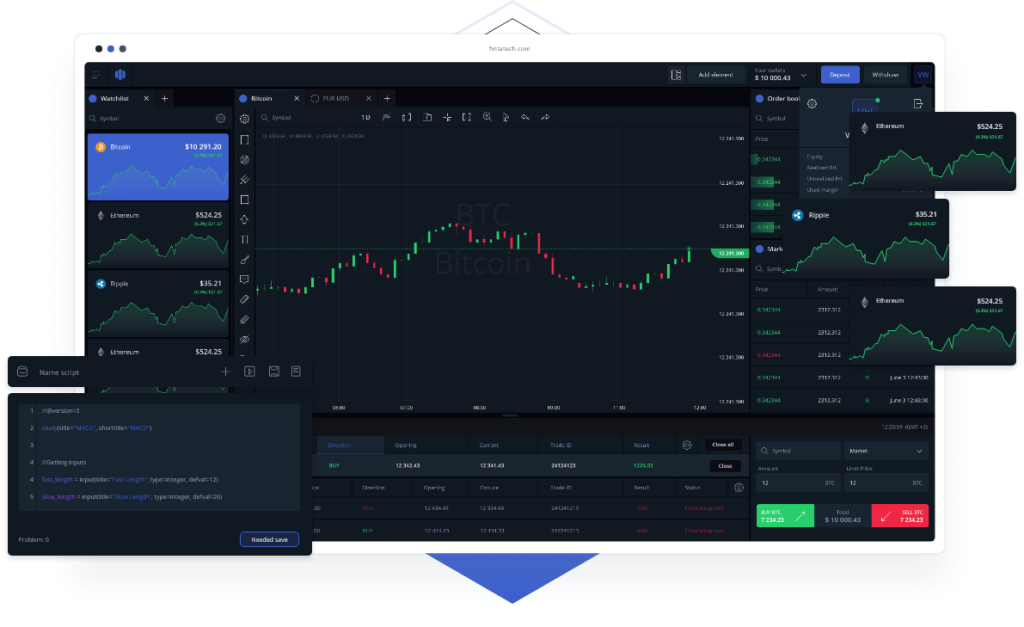

To profit from financial success in forex market movements, traders need to adopt a disciplined and informed approach. One common strategy is to engage in technical analysis, which involves studying historical price data and using chart patterns and indicators to predict future movements. Technical traders often rely on tools like moving averages, Fibonacci retracements, and oscillators to identify entry and exit points. Another approach is fundamental analysis, where traders assess economic indicators, central bank policies, and geopolitical events to forecast currency movements. This method requires staying updated on global news and understanding how different factors interact to influence currency prices. Risk management is essential in Forex trading. The use of stop-loss orders, which automatically close a trade when the price moves against the trader, helps to limit losses. Proper position sizing, where traders risk only a small percentage of their capital on each trade, is also critical to long-term success. Leveraging the power of leverage can amplify profits but also increase risks. Traders should use leverage cautiously, ensuring they fully understand the potential for both gains and losses.